Markets too complacent in face of political turmoil

Written September 24, 2019

Despite a lack of facts, Washington has been consumed by accusations that President Trump acted improperly in a phone call with his Ukrainian counterpart, with many claiming that it qualifies as an impeachable offense. That conclusion may or may not be true. More will be known after acting Director of National Intelligence Joseph Maguire addresses the whistleblower complaint that sparked the controversy before the House Intelligence Committee on Thursday, September 26.

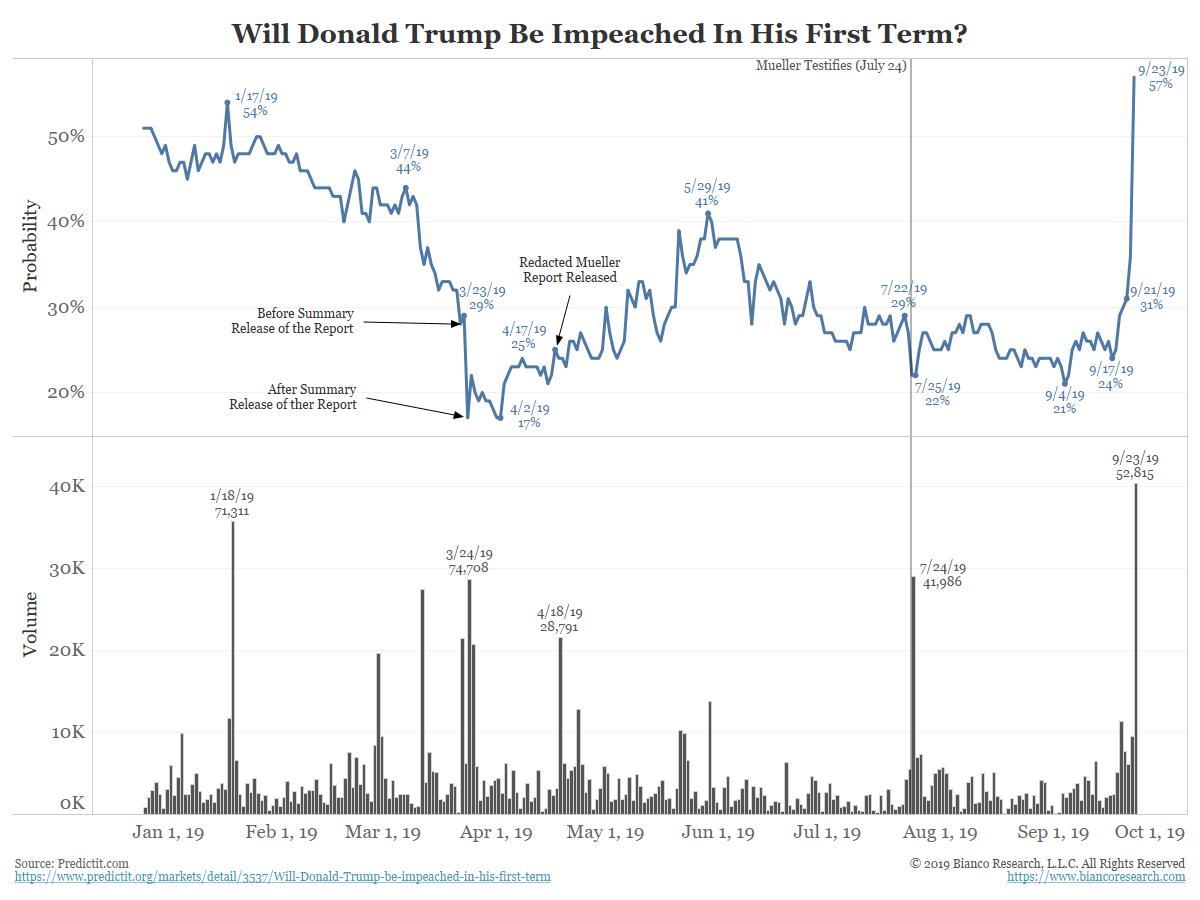

Odds for Trump’s impeachment spiked yesterday on the betting market Predictit to 57%, the highest level this year. This matches a growing number within the Democrat caucus that believe the president should be removed.

At the same time, the S&P is trading about 1% from record highs and the broad market’s primary fear gauge, the CBOE Volatility Index (VIX Index), is near the lower end of its range. In short, a picture of complacency.

It’s hard to see how these two conditions are mutually compatible for very long. One side is wrong.

The hallmark of the Trump presidency has been a bull market in stocks, and any threat to his tenure would almost certainly inject a level of uncertainty that would be reflected through lower prices. While it is unknown if he will be impeached, that outcome and any potential negative fallout in the equity markets presents the more favorable risk/reward trading profile. The bet is that the markets are currently underpricing the disruption and volatility that such an event would produce.

Even though the VIX appears subdued, price action is positive. Since spring, the VIX has been tracing out a classically bullish pattern of higher highs and higher lows (see chart below). As long as each prior low print holds, in this case, the September 19 low of 13.30, pullbacks are buying opportunities.

2 thoughts on “VIX Cheap as Impeachment Threat Grows”