Investors blindsided by the virus shouldn’t compound their problems by thinking that things will immediately return to normal once it passes.

It’s hard to predict the outcome of unprecedented events because, by definition, they’ve never happened before and handicapping them is nearly impossible. The models used by scientists to justify a complete shutdown of the global economy to mitigate the spread of the coronavirus may turn out to be off by a factor of ten, or more. It’s not meant as an indictment of them but an acknowledgment that like most investors trying to navigate the markets, they haven’t done this before either. At least not on this scale.

For that same reason, we should be skeptical of forecasts of a swift rebound once the virus passes. Just like how faulty data skews computer models, those calls seem to grossly underestimate the potential long-term damage to consumer confidence, supply chains, and the rejection of globalism in general. Garbage in, garbage out.

We were warning all of last year that markets were in an increasingly precarious position. See “Stall Speed“, “Tipping Point” and “Powell Plays for Time“. A decade of excessive monetary stimulus provided by the major central banks since the last recession in 2009 had all but destroyed the price discovery function of markets and dulled investors to signs of trouble. Record equity prices as a result of the Fed’s guiding hand and abundant liquidity obscured unsustainable debt burdens, slowing economic growth, declining corporate earnings and deteriorating credit quality. Many believed, and likely still do, in the Fed’s ability to extend the business cycle forever and revive the 11-year old bull market. To us the contradiction is nuts but as the old saying goes, the markets can stay irrational longer than you can stay solvent.

The virus exposed some serious vulnerabilities of the global economy, most notably the level of debt. As a result, we think that the economic adjustment to new societal norms and changes in consumption behaviors will take longer to play out than most of us can conceive.

Government officials and other commentators who are pushing a narrative of a V-shaped economic recovery are wrong on two basic assumptions.

1) It ignores the global debt dynamic, and the possibility that this event represented a tipping point long in the making. An unintended consequence of quantitative easing programs was companies taking advantage of cheap money to buy back their own stock and pay dividends rather than investing in their businesses. That’s now over, especially for any entity accepting federal assistance. And it should be.

Despite low rates and lots of government cash on offer, corporations will be forced to de-leverage their balance sheets to align with a new economic reality, which will come at the expense of capital spending, investment, and employment. Borrowing and refinancing costs could also rise as many companies suffer rating downgrades or find access to funds restricted by wary lenders. Businesses operating on thin margins, even large corporations, may not survive. If they do they are likely to run mean and lean for years to come rather than re-staff their employee ranks.

2) The claim of pent-up demand is ludicrous. Consumers are in shock. If you weren’t worried about your job before, you sure as hell are now. Just because your job might have survived the initial wave of layoffs it doesn’t mean it won’t get eliminated as the fallout ripples through the economy. Free government handouts will keep the lights on but don’t fool yourself into thinking that it is stimulative.

Rent payments that got waived in April are going to have to be paid in full in May or June, in addition to the current amount due. Credit card interest will continue to accrue. Most mortgages have been securitized, making it impossible to extend the terms and simply add missed payments onto the back end of the loan. Sure, you can defer several months’ payments but the bank is going to want all that back in a lump sum sometime this summer. And if you skipped eating out ten times or missed three haircuts while on lockdown, you’re not going to then go order ten meals when the curfew is lifted.

To steal a term from former Secretary of Defense Donald Rumsfeld, there are still too many unknown unknowns right now. To conclude that things will return to pre-virus normal is fantasy.

Many of us grew up hearing stories about the Great Depression of the 1930s. Unemployment then peaked at around 25%, and it affected spending habits for two generations. People hoarded, they saved. Like my parents and their parents before them, they never let go of that mindset.

Governments and central banks are literally throwing money at both the markets and at citizens alike in an effort to stop the bleeding, but for the reasons stated above it may not be enough. Don’t confuse liquidity with solvency. The Fed might be able to address the former, but for many, the latter is still very much a risk.

One big positive for the economy is the resilience of the American consumer. The labor force is more flexible, means of communication and transportation more efficient and capital markets more dynamic than it was last century. Technology helps society to adapt to changing conditions almost instantaneously. In large measures, people can now work and shop from home. The shutdown may actually open our eyes to better and more efficient ways of conducting our day-to-day lives.

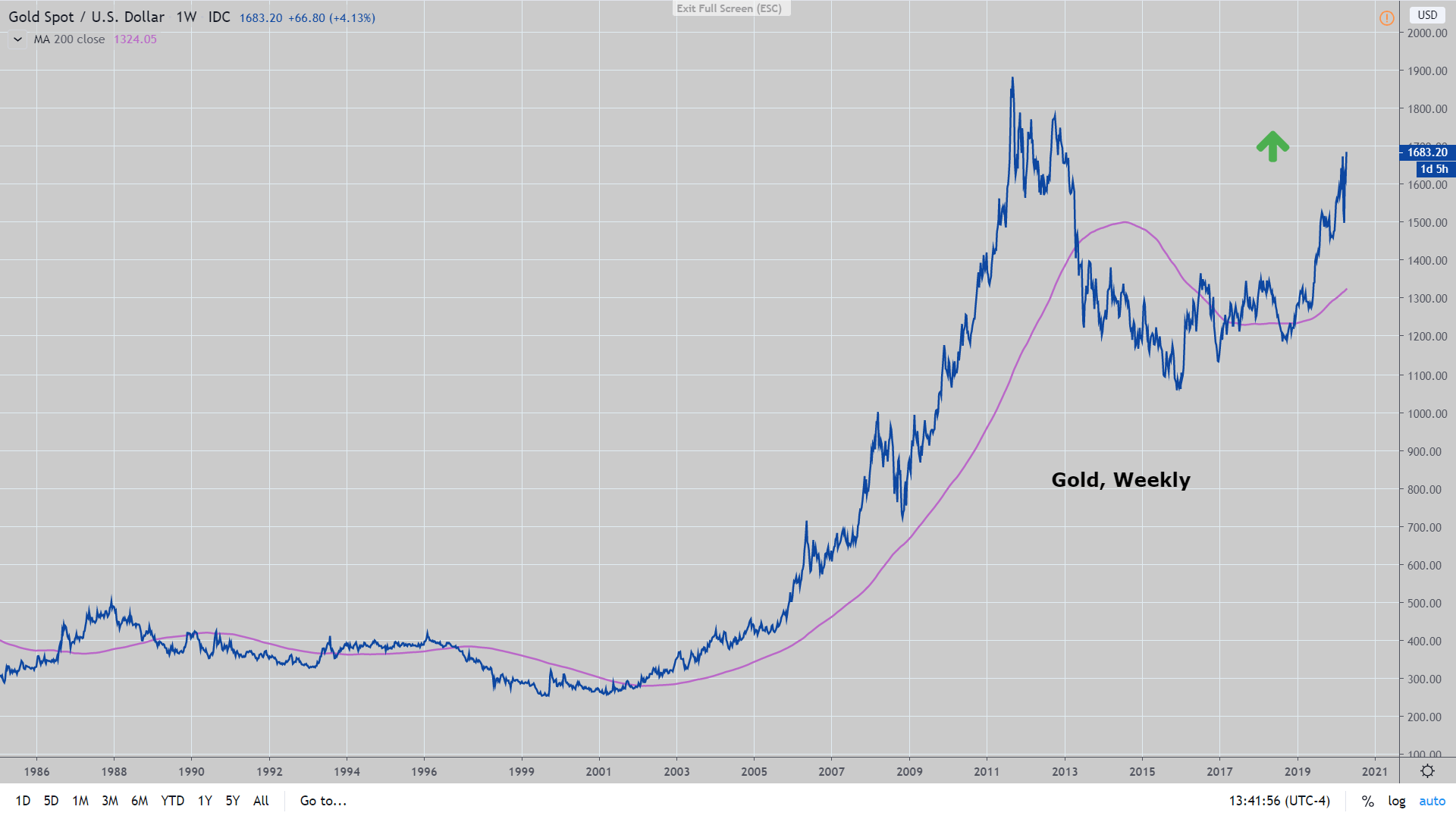

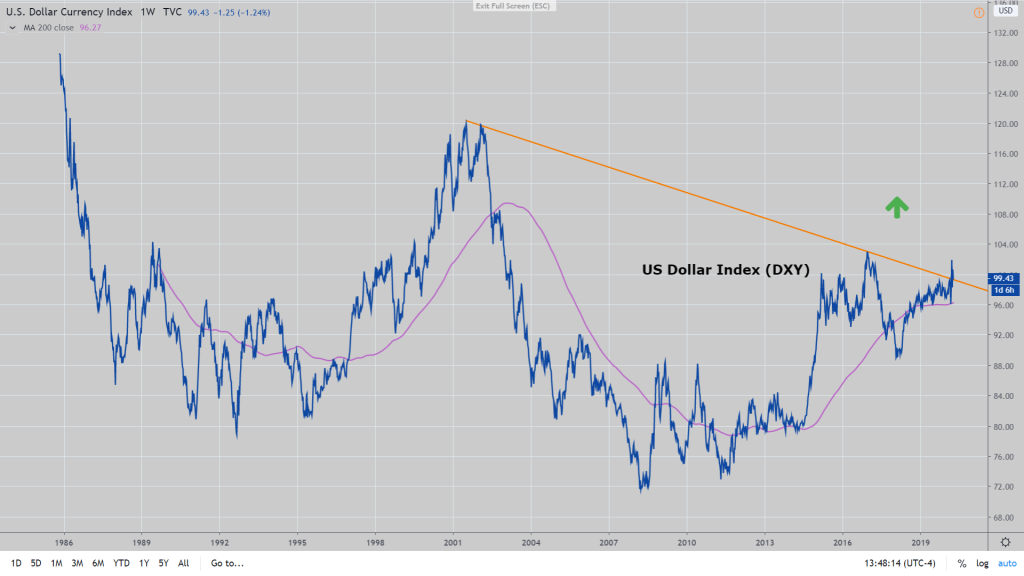

While nobody could have forecast the COVID-19 virus, at this time last year we recommended being long of the U.S. dollar and front-end treasuries as a play on slowing global growth. We still like those positions but would urge readers to consider adding physical gold to their portfolios and use this rebound in stocks to reduce risk exposure. In the months and years ahead, many countries will be making moves to weaken their currencies (i.e. printing money) to stimulate their economies and regain an advantage in international trade. Gold is the flip-side of the depreciating fiat money coin.

So when William Devane appears on your TV urging you to buy precious metals as a hedge against “unstable governments printing paper money”, know that he may be on to something.