Inadequate funding a potential problem for markets

Written September 26, 2019

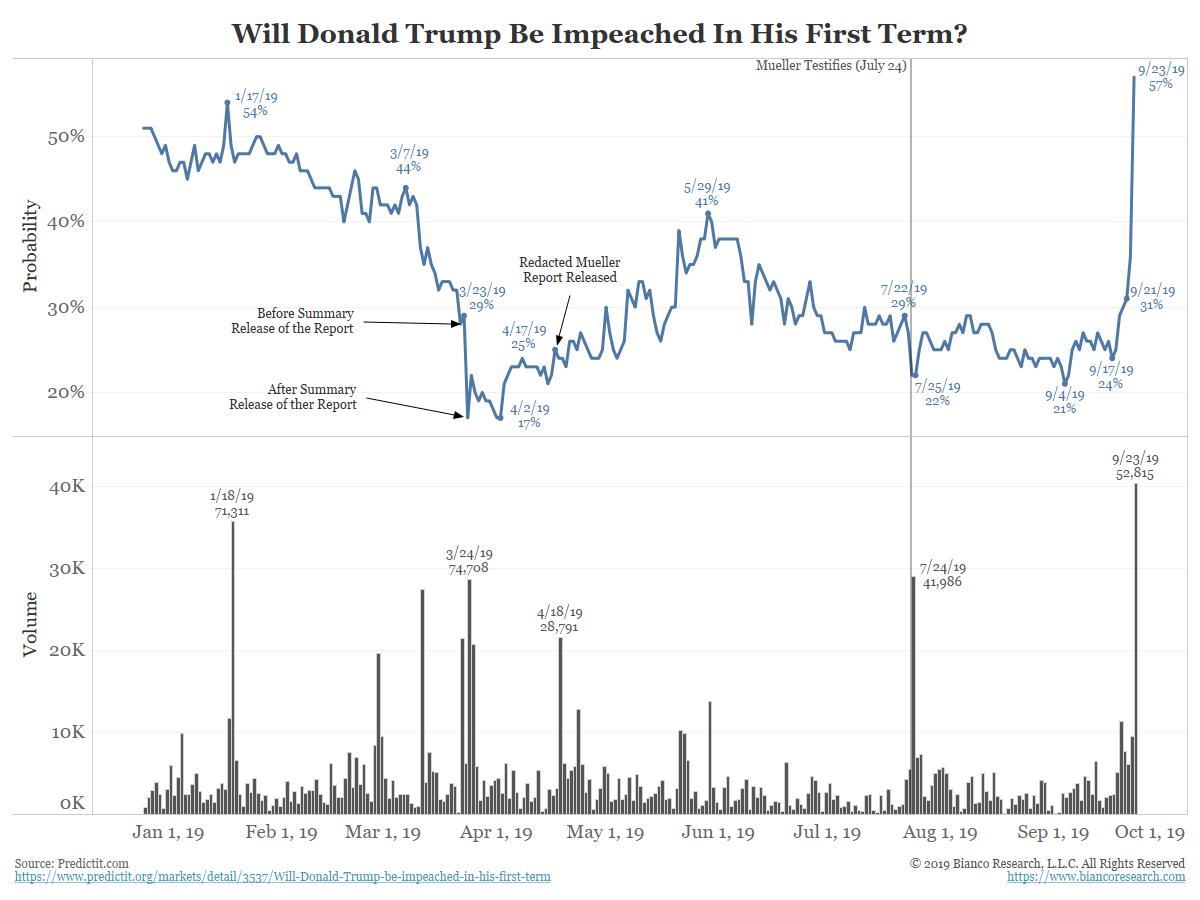

Just like the equity market’s general complacency over the uncertainty created by a potential presidential impeachment, it is exhibiting a similar lack of interest in the ongoing liquidity squeeze in short-term funding markets.

A sharp spike in overnight financing rates last week due to a scarcity of bank reserves was initially dismissed as an unexpected confluence of technical factors. Everything from quarterly tax bills, treasury auction settlements, and principal and interest payments were blamed for draining an unusual amount of money from the system and causing an acute shortage of free reserves. Overnight rates were said to have traded as high as 10% before the Fed was forced to step in with emergency funds. The panic passed but the underlying problem hasn’t gone away. Lots of confusion still hangs over the money markets. Financing remains tight, enough so that the Fed has had to supplement the system with cash every day since. This is not normal and the longer it goes on the explanation that it is merely a temporary quirk becomes less credible.

As of now, the consensus opinion is that this problem will fix itself simply by a turn of the calendar past quarter-end (September 30). That seems to be a big leap of faith. In a Bloomberg piece today former Minneapolis Fed President Narayana Kocherlakota says that regulatory changes after the 2008 crisis, like more stringent capital and leverage requirements, have restricted the amount of free reserves in the financial system and banks’ willingness to lend those reserves among themselves. See https://bloom.bg/2mGcO3B. None of this was a problem while the Fed was expanding its balance sheet and providing almost limitless liquidity. Only when the Fed began to shrink its balance sheet a year ago did this unintended consequence emerge.

The explosion in the issuance of US dollar-based debt, both domestic and foreign, during the previous decade of easy money policies created a massive need to finance that debt. What has now become obvious is that without additional liquidity provided by the Fed, there just aren’t enough dollars in the system to go around. Kocherlakota notes that “the financial system is acting like it has $1.3 billion in excess reserves rather than the actual $1.3 trillion.”

This means the Fed can forget about any plans they might have had for normalizing interest rates and reducing their balance sheet. Quite the opposite, it slants the probabilities in the direction of even lower rates. The problem in the money markets is structural and has disrupted one of the financial markets’ most essential functions. Until they figure out how to fix it, simple liquidity will become an ever-important consideration for investors. Fundamental investment strategies don’t matter much if they can’t be financed.

The fourth quarter of 2019 will see two issues elevated that were not big considerations in the current quarter: domestic political uncertainty and liquidity uncertainty. These factors should lead to a general increase in market volatility as well as heightened concern over funding availability. This will almost certainly force banks and asset managers to begin paring back positions for year-end earlier than ever. Additionally, rate cuts at Fed meetings in October (Oct 29-30) and December (Dec 10-11) will be in play as the Fed seeks to offset the slowing economy and keep funding pressures contained.

The two simplest trade opportunities are 1) long equity volatility such as the VIX (see VIX Cheap as Impeachment Threat Grows) and 2) long Eurodollar interest rate futures, such as the Dec 2021 contract. Policy rates in the U.S. are on their way to zero and there’s a lot left in this trade.