The largest position in the history of the financial markets is about to get squeezed.

Written April 27th, 2020

Successful traders are always asking themselves two questions in the course of analyzing markets: 1) given a set of known inputs, are markets behaving as expected? and 2) if not, why not?

Since the COVID-19 pandemic crashed the world’s financial markets last month, central banks have responded with extraordinary measures to stabilize markets and prop up their respective economies.

For its part, the Fed has undertaken policies on a scale unprecedented in the history of finance, radically expanding their balance sheet and going so far as lending directly to municipalities and buying junk bond ETFs in the open market. Essentially printing money, but on steroids.

The equity markets have responded favorably, much as one would expect given the deluge of liquidity. It’s a reflexive response conditioned by a decade of the Fed propping up asset prices every time the markets stumbled. Will it last? Nobody knows.

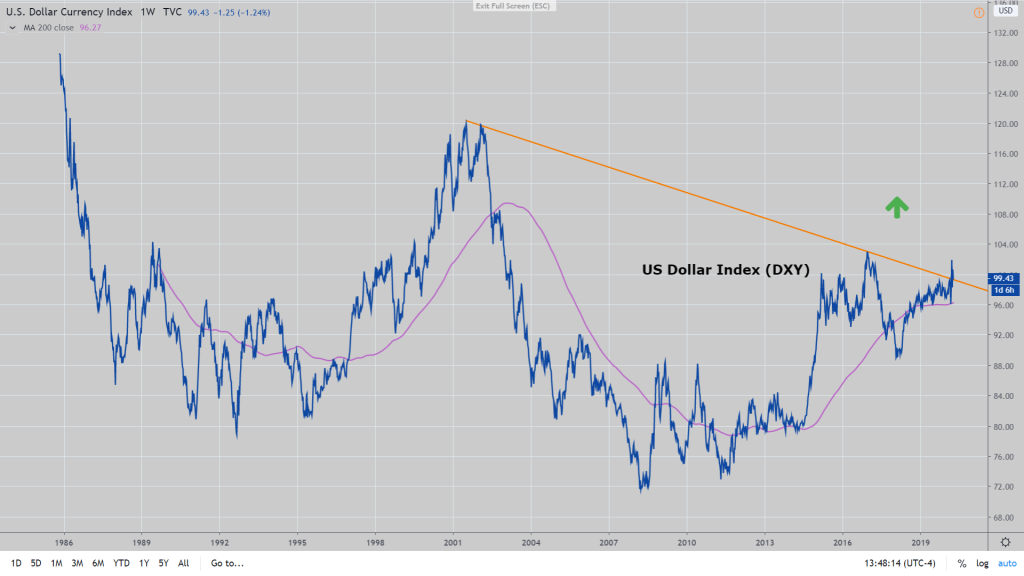

However, the part of this scenario that is not going according to plan is potentially the most consequential for the financial markets. The US dollar needs to weaken. Big time. For a global economy staring at a tsunami of deflation, it is the most critical element to achieving a durable reflation of commodities and equity prices and restoring confidence in many regions of the world, especially the emerging markets.

This is not lost on central bank officials. In fact, if you were asked to come up with a policy to destroy your own currency, moves by the Fed and the Treasury over the past month to explode the federal deficit would be it.

The speculative trading community initially took the cue. According to CFTC data, the specs began shorting the dollar in the middle of March as rates went to zero and the money printing presses began working overtime.

But since then, not only hasn’t the dollar gone down, it is higher instead.

The latest study by the Bank for International Settlements estimates the world’s short position in the dollar at about $13 trillion, much of it based on dollar debt held by offshore banks and corporations, representing the largest aggregate position in the financial markets by far.

Currency swap facilities instituted and expanded by the Federal Reserve with the intention of ensuring these entities access to dollar funding helped settle the markets late last month, but the currency’s appreciation since then is a sure sign that it won’t be enough. For many of these foreign corporations, swap lines are of little value if their respective central banks don’t have sufficient reserves to swap or US Treasury securities to pledge as collateral.

Also, printing trillions won’t do much good if there is no turnover, or velocity, of that money due to the collapse in business activity. It just ends up in the vaults of institutions that don’t need it, crowding out the weaker borrowers.

Against all expectations, the steady grind higher in the dollar in recent weeks is a red flag that this massive short trade is about to get squeezed.

The implications will be felt everywhere. The risk to the broader economy is that a stronger dollar triggers a doom loop of debt deflation, where slower global growth causes the dollar to rise and a stronger dollar, in turn, depresses prices and causes growth to slow.

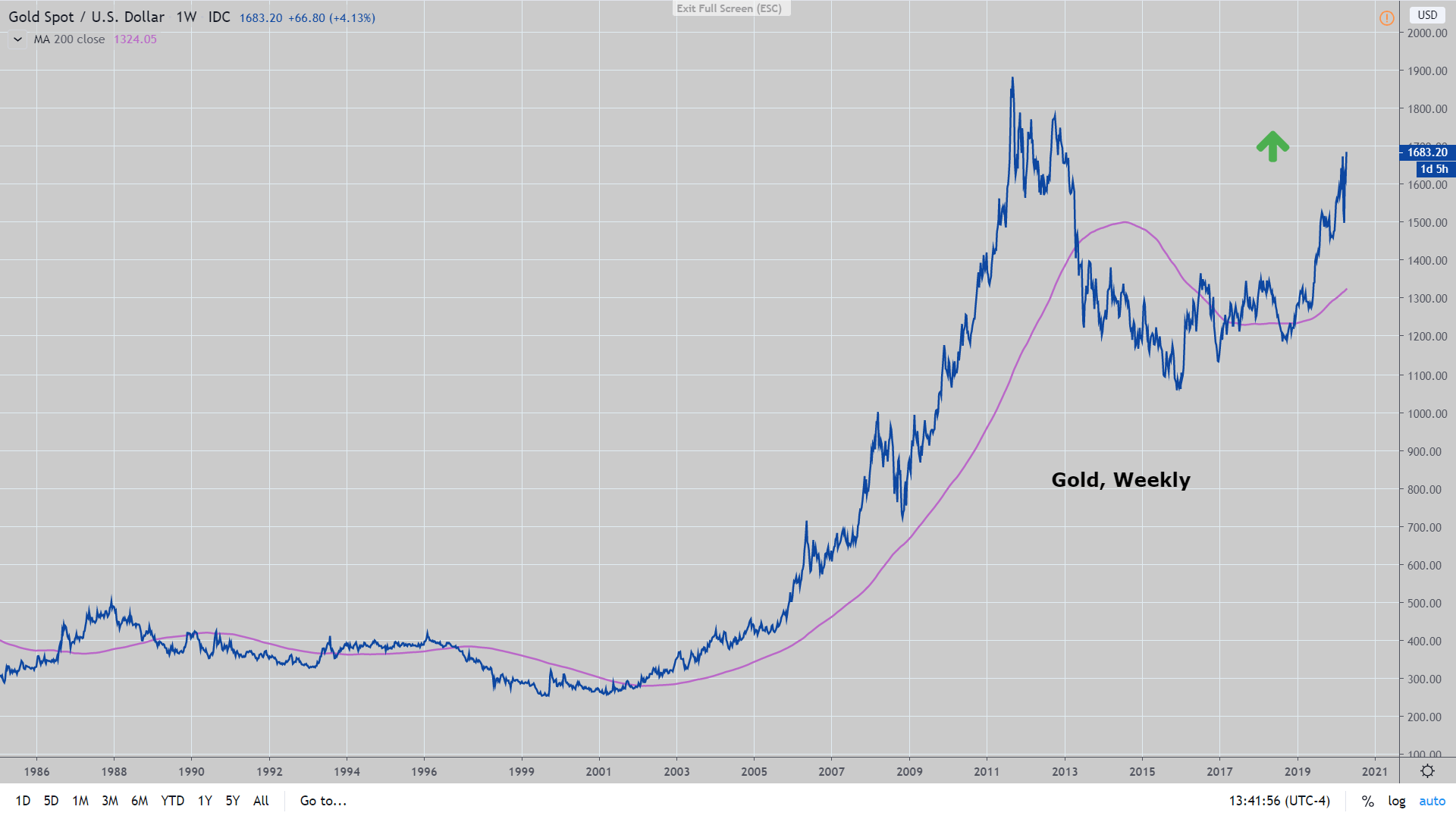

As we’ve been recommending for more than a year, stick with long positions in the dollar and front-end treasuries. In our last piece “The L-Shaped Recovery“, we suggested adding physical gold and taking advantage of near-term strength in equities to reduce exposure. If the dollar starts to accelerate, things could get ugly. Quickly. And despite the Fed’s insistence on not taking interest rates negative, it’s not impossible that this will end up being their next move.